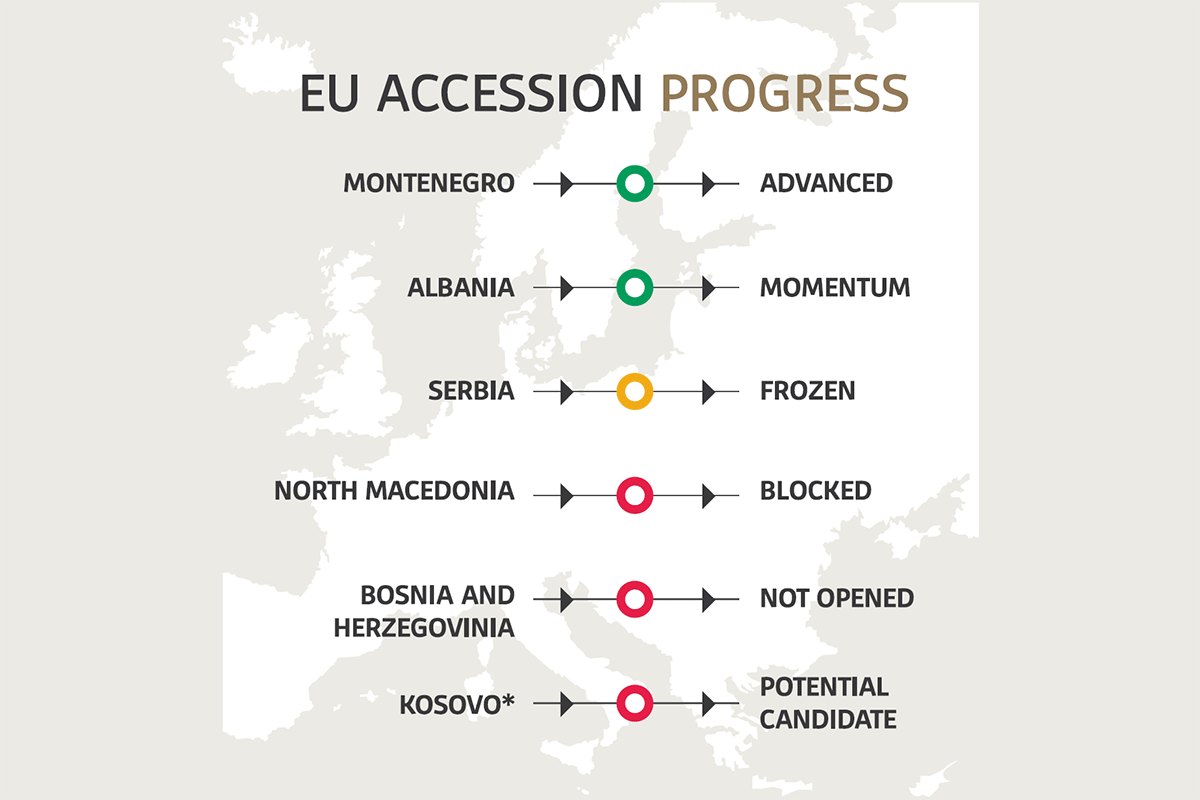

The EU’s 2025 Enlargement Reports aren’t just political documents — they’re market signals. They shape investor confidence, regulatory timelines, cross-border financing, and the future cost of doing business in the region. Some markets are accelerating toward EU standards, others are slowing, and a few are trapped in political stop-and-go. Here’s what business leaders need to know, country by country.

Albania

— Regional Climber, Getting More Investable

Albania remains one of the region’s most promising markets. The justice reform continues to clean up the institutional environment, although high-level corruption cases still lag. The opening of all negotiation clusters positions Albania firmly on the EU track, increasing long-term predictability for investors. Brussels warns that administrative capacity must improve — meaning regulatory implementation could be uneven in the short term. The fundamentals are solid: growth is steady, EU alignment is high, and the reform agenda is alive. For companies, Albania is becoming a safer medium-term bet, but with bureaucratic bottlenecks still to watch.

Montenegro

— Strong EU Trajectory, Weak Political Stability

Montenegro remains technically closest to EU membership, which helps anchor investor sentiment. However, political instability and slow institutional reform continue to generate uncertainty. Rule-of-law gaps and fragile anti-corruption structures raise risk premiums, especially for long-horizon investments. The economy is vulnerable to shocks due to its dependence on tourism, but EU-aligned policies support financial-sector resilience. Brussels’ message for business is clear: Montenegro’s direction is positive, but volatility in governance means due diligence must stay tight.

Serbia

— Europe’s Biggest Market, Stuck in Political Traffic

Serbia offers scale and strong infrastructure, but the 2025 report signals rising political and regulatory risk. Weakening democratic standards and limited progress in the rule of law increase uncertainty for investors who depend on fair competition and stable institutions.

Foreign-policy misalignment with the EU widens the strategic gap, potentially slowing integration into European value chains. No new clusters have opened since 2021 — a signal that Serbia’s EU pace is flat. For businesses, this means opportunity still exists, but with growing caution around governance, predictability and geopolitical positioning.

North Macedonia

— Strong Fundamentals, Blocked Momentum

North Macedonia has done much of the institutional homework that investors like: foreign-policy alignment, stable macro-framework, and completed EU screening. But political blockages outside its control — primarily the dispute with Bulgaria — freeze its accession progress.

“Reforms are progressing — but implementation is the real test.”

EU Enlargement Report 2025

Regulatory reforms continue, but the psychological factor matters: businesses see a country ready to move, stuck in an EU waiting room. The economy remains moderately prepared with solid human capital, but talent emigration and slow productivity gains limit scale. For investors, the fundamentals are still favourable — but the timeline is uncertain.

Bosnia and Herzegovina

— High Potential, Systemic Risk

Bosnia and Herzegovina shows small steps forward but remains the region’s most unpredictable market. Political tensions, institutional fragmentation and a chronically weak judiciary are the core risks. While reforms like the Frontex agreement and digital advancements signal movement, the business environment remains constrained by slow decision-making, overlapping competences and unstable governance. EU negotiations could open — but only once major reforms are implemented. For investors, this is still a high-opportunity, high-risk environment requiring patience and strong local partnerships.

Kosovo*

— Dynamic Market, Politically Limited Path

Kosovo* has some of the strongest pro-EU sentiment in the region and a young, dynamic workforce. Visa liberalisation boosts mobility and business ties. The EU notes progress in judicial and anti-corruption frameworks, but implementation gaps persist, including limited track records in high-profile cases. Economic growth is strong yet heavily reliant on remittances, and unemployment remains high. The main strategic constraint is political: Kosovo’s EU path depends on the dialogue with Serbia and recognition obstacles within the EU. For businesses, Kosovo* offers energy and growth, but structural risk remains significant.

This designation is without prejudice to positions on status and is in line with UNSCR 1244/99 and the ICJ Opinion on Kosovo’s declaration of independence.