Economic leaders in the Adriatic rim map a path from fragility to momentum

A Region At A Ridge

The Adriatic arc — from Slovenia and Croatia into Bosnia and Herzegovina, Montenegro, Albania, Serbia, and North Macedonia — now finds itself on a ridge. One wrong step, and the region could tumble back into fragmentation and stagnation. But the other way lies a chance to leap forward.

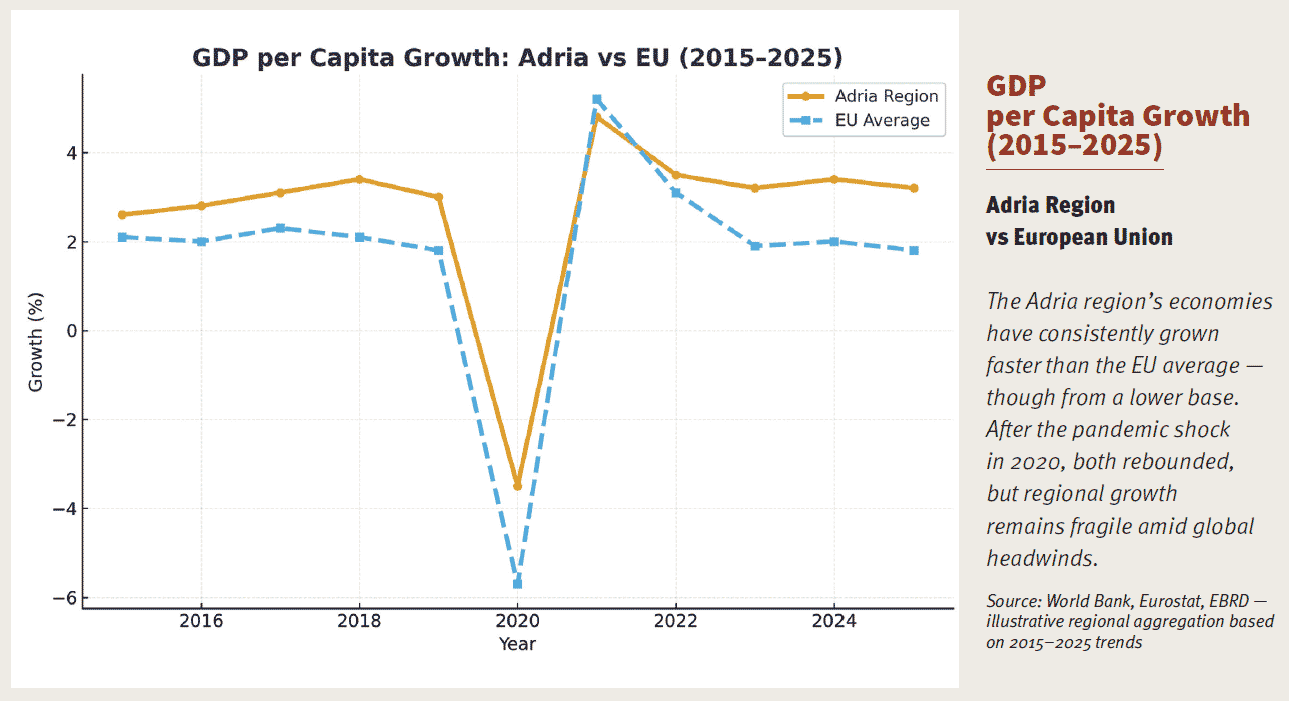

The six Western Balkan economies (Albania, Bosnia & Herzegovina, Kosovo, Montenegro, North Macedonia, Serbia) are forecast to grow about 3.2 percent in 2025, slipping from 3.6 percent in 2024, before recovering to roughly 3.5 percent in 2026. This softening reflects external headwinds and fragile global demand. Meanwhile, inflation has eased in many economies; public investment and wage growth are (in some places) helping guard consumption.

(Source: World Bank Western Balkans Regular Economic Report, Spring 2025)

Yet headline stability masks deeper tensions. Labor participation remains low (especially among youth and women), migration persists, and the working-age population is already shrinking — projected to fall by nearly one-fifth by 2050.

This demographic squeeze intensifies the need for higher productivity, not just more labor.

The EU has responded with a bold program: a €6 billion Growth and Reform Facility (2024–2027), combining grants and loans tied to institutional and structural reform. But money is a tool, not a guarantee. Without governance alignment, regional coordination, and credible rule of law, capital may steer clear.

Across the Adriatic spine, leaders in government, business, and civil society are debating a simple, urgent question: How to make this moment count?

Four Pillars To Sustainable Growth

1. Energy Transition: From Risk to Competitive Edge

Adria’s geographic endowments — sunlit coasts, mountain winds, river systems — make clean energy its most credible industrial play. But turning promise into pipelines requires more than ambition: it demands regulatory consistency, grid integration across borders, and long-term purchase agreements.

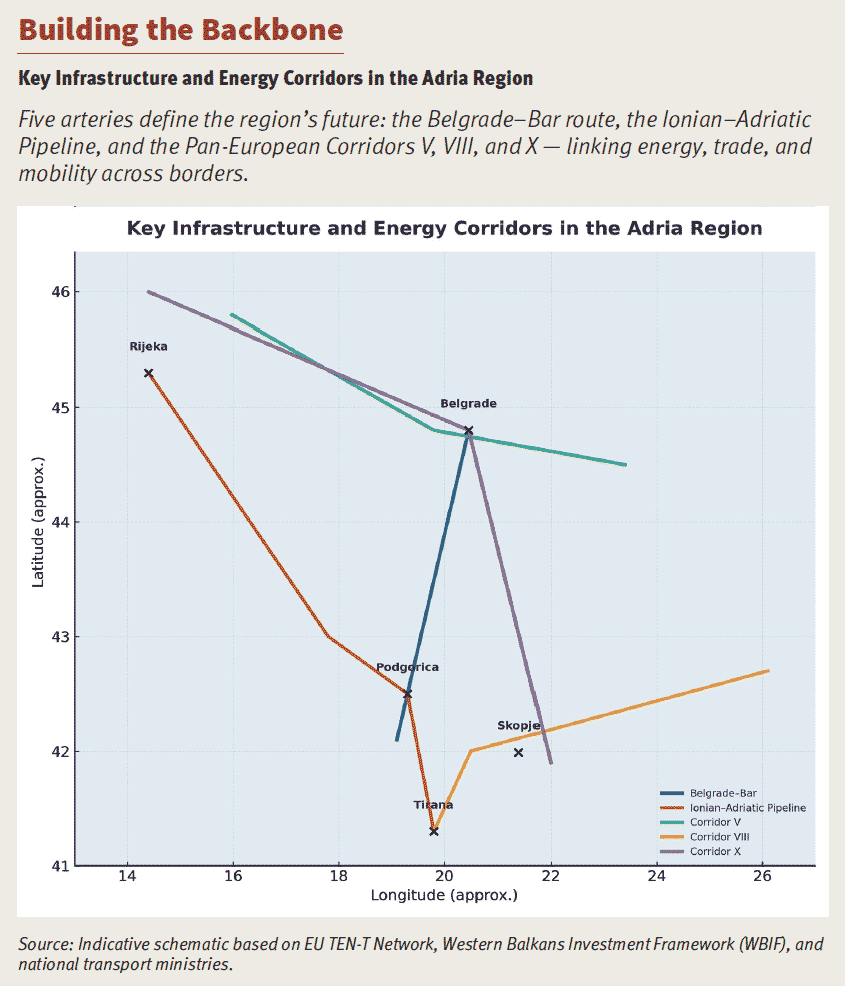

One key project is the Ionian-Adriatic Pipeline (IAP): a roughly 500 km conduit designed to link Albania through Montenegro and Bosnia & Herzegovina to Croatia’s pipeline network. It is currently in design phases, with support from the Western Balkans Investment Framework and early-stage financing. Its future will depend on how well the region aligns energy strategies and balances fossil fallback with renewables.

Yet even more crucial is the shift beyond gas pipelines — toward solar clusters, wind farms, energy storage, regional power exchanges, and distributed clean grids. That is where the durable advantage lies.

2. Digital & AI: Stretching the Frontier of Productivity

With shrinking labor pools and persistent migration, growth must be driven by intelligence, not raw numbers. Automation, AI, smart logistics, precision agriculture, and e-governance are not luxuries — they are survival tools.

Several governments now pilot AI tools in public services or smart-city applications; companies in Ljubljana, Belgrade, and Tirana are beginning to export software to Western Europe. But adoption is uneven — constraints include skills gaps, uneven broadband infrastructure, and regulatory uncertainty.

Bridging that divide will require aligned incentives, regional digital platforms, and joint investments in education.

3. Connectivity & Corridor Thinking

Infrastructure in the region remains fragmented. Roads stop at borders, rail lines lack interoperability, and ports struggle to reach inland markets. The EU’s Growth Facility and the Western Balkans Investment Framework together back dozens of transport, energy, and environment projects. Over 146 WBIF projects have generated investments in infrastructure realms exceeding EUR 10.9 billion to date.

What’s missing is coherence. The region needs corridor thinking — linking ports to factories, rail to inland markets, energy lines across states. Only then can the sum of national infrastructure become a regional scaffold for growth.

4. Human Capital & Institutional Renewal

None of the above can deliver if trust is broken and talent flees. The region continues to lose professionals to Europe. But more than that: business leaders and economists routinely point to governance — rule of law, predictable regulation, meritocratic institutions — as decisive bottlenecks.

Reforms must reach deep: procurement transparency, judicial independence, anti-corruption enforcement, administrative simplification. Simultaneously, education and vocational training must tie to future sectors, and diaspora networks should be re-engaged to bring back skills, capital, and ideas.

Strategies Beyond Rhetoric

In boardrooms across Adria, C-suite leaders and analysts are no longer debating “vision.” They debate durability. Their evolving playbooks include:

Scenario over script: In uncertain times, the best plans are modular. Leading companies run parallel scenarios — e.g. green acceleration, faltering growth, supply disruptions — to preserve flexibility.

ESG not as compliance, but as strategic license: Environmental, social, and governance metrics are ceasing to be checkboxes. They become reputational capital, and in some cases, access to capital itself.

Clusters over solo scale-ups: Instead of betting on one startup, regional actors are creating specialized clusters (energy + storage, digital + AI, logistics + circular economy) spread across national borders but tightly coordinated.

“Act regional, execute local”: Regional alignment on energy rules, trade protocols, digital standards can unlock scale — while local implementation ensures relevance and agility.

Governance discipline as growth policy: Credible promises — stable policy, fiscal probity, regulatory certainty — now matter as much as highways and power lines.

Hands-on pilots are already illuminating the path:

Cities deploying smart meters to reduce grid losses, municipalities installing rooftop solar on public buildings, digital “one-stop” enterprise registration platforms, cross-border tourism circuits working to harmonize visas and marketing. These are small in scale but signal a new mindset.

Still, trade-offs loom. Legacy industries may contract. Retraining and safety nets will have to cushion communities. The transition will have its casualties, and they must not be ignored.

A Decade Of Decision

If everything aligns — institutional trust restored, regional cooperation deepened, clean energy and digital sectors scaled — then by 2035 Adria could be closing half the gap with EU living standards. Its exports might center not on raw materials but on clean tech, digital services, smart agriculture. Ports could hum with green fuels. The region might retain its brightest minds rather than exporting them.

But the margin for error is narrow. External shocks — debt stress, trade tensions, climate extremes — could unravel gains. Political backsliding or contradictory national agendas might fragment the regional project. Environmental miscalculations could turn growth into exposure.

Here’s what to watch: public and sovereign spreads in Balkan markets, speed of corridor construction, return migration trends, sectoral investment flows (especially in green and digital), and reform benchmarks under the EU’s Growth Plan.

This is not a story of passive convergence. It’s a wager — that a region long defined by periphery can become central in Europe’s next chapter. The next five years will determine whether Adria’s future is built or merely deferred.

Adria stands at a hinge: the difference between possibility and path dependency is in the act, not the intention.